How Our Snooker Betting Strategy Outperformed Expectations

Disclaimer

This blog post offers insights into sports betting strategies for educational purposes only. We do not disclose the exact model implementation used to avoid encouraging risky behavior. Betting involves significant risk, and there are no guarantees of profits. Always bet responsibly and within your means. It’s crucial to seek help if you or someone you know struggles with gambling issues. The effectiveness of any strategy can vary, and past performance does not indicate future results. Conduct your own research and consider your personal circumstances before betting.

Introduction

Snooker is more than just a game of precision and skill; it’s a mental battle played out on a green baize, where the stakes are high, and every shot counts. From the crowd’s hushed silence to the players’ intense focus, snooker captivates millions with its blend of strategy, finesse, and unpredictability. But for those who truly understand the game, snooker offers something even more thrilling — a chance to turn knowledge into profit through betting. Whether you’re a seasoned fan or new to the sport, the prospect of betting on snooker can transform watching a match into an electrifying experience. With the right strategies and a bit of luck, snooker betting holds endless possibilities. In the following, we will present a model that has performed well in the last six months.

Model

We selected a straightforward model based on the ELO rating system, a method originally designed for chess that is now widely used in various sports. The ELO rating is calculated using historical performance data, incorporating a player’s overall career rating and a performance trend over the past three months. The ELO rating for each player is updated daily before prediction to reflect the most current data.

We use the Kelly criterion, a mathematical formula developed by John L. Kelly Jr. in 1956, to optimize our betting strategy. The Kelly criterion determines the optimal wager size for each bet, considering the probability of winning and the odds offered. This ensures that we maximize growth while effectively managing risk and not betting on non-profitable matches.

Result

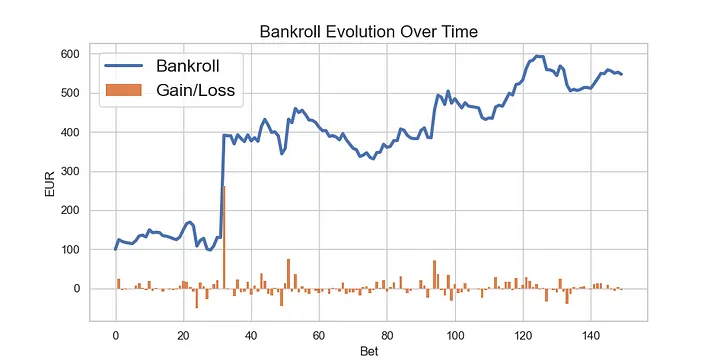

The model was tested on approximately 370 matches between March 2024 and August 2024. The model identified 150 games where the odds were profitable, and bets were placed accordingly. We began with an initial bankroll of €100, with a maximum of 90% of this bankroll wagered on any single bet. All bets were placed on the Unibet platform. The graph below illustrates the evolution of our bankroll over time.

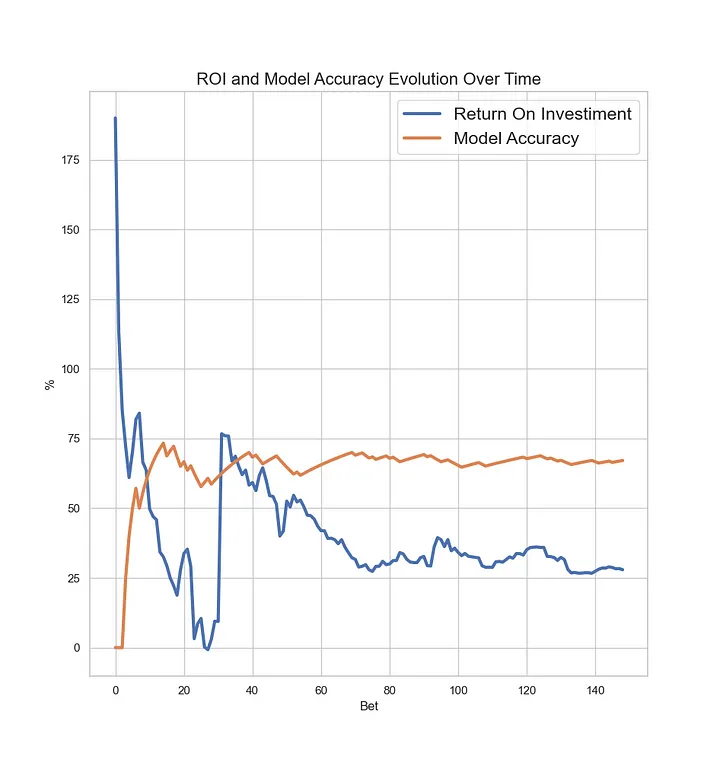

The gold standard benchmark for evaluating sports betting models is the Return on Investment (ROI). ROI is influenced by various factors, some within the bettor’s control and some not. The main drivers of ROI are the model’s prediction accuracy and the odds offered by the bookmaker. Typically, the betting system is designed so that achieving an ROI exceeding 2% is rare, making anything higher a significant achievement. The graph below shows our ROI’s evolution over time and our model’s prediction accuracy. Ultimately, the ROI and accuracy stabilize at 28% and 68%, respectively.

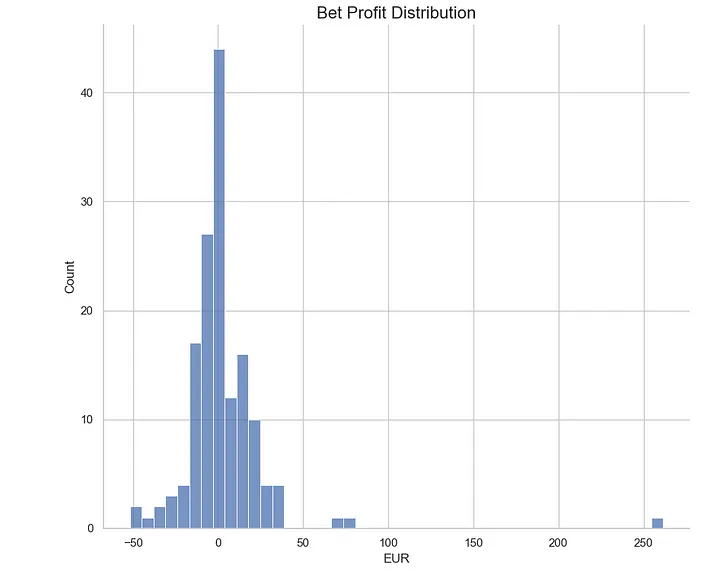

We also provide the distribution of the profits (where positive values indicate gains and negative values indicate losses) for each bet. We see that the mean profit per bet was €3.00, with a skewness of 5.84, indicating that the distribution is biased toward gains.

Analysis

The first conclusion we can draw from our experiment — which seasoned sports bettors will immediately recognize — is that the model does not exclusively bet on matches where the predicted outcome is a win. In fact, the model often places bets on players who are more likely to lose but offer better odds. This concept is central to betting strategy: it’s not about betting solely on the most likely winners, but on opportunities where the odds provide value. Following the model’s guidance is crucial, even when it seems counterintuitive or risky, as abandoning the strategy could lead to missed profitable opportunities.

By the end of the experiment, the ROI was close to 28%, which is exceptionally high, with the model’s prediction accuracy near 70%. This extraordinary ROI can be attributed to several factors, ranked here by their lowest impact first:

- Model Accuracy: The model has proven to be highly efficient, with a solid accuracy rate of 70%. Additionally, its selectivity — betting on fewer than 35% of all available matches — ensures that only the most favorable opportunities are taken.

- Market Inefficiencies: The snooker betting market exhibits inefficiencies in setting odds. The model capitalizes on these mispricings, consistently placing value bets that are profitable in the long run. For instance, the mean profit per bet was only €3.00. This indicates that while most profits were moderate (ROI of 12% excluding outliers), several highly profitable bets significantly boosted overall performance (ROI of 28% overall). A prime example is the match between Stan Moody and Mohamed Shehab, where the model recommended betting on Shehab. With a prediction of a 72% chance of winning and odds of 5.40, this bet resulted in a profit of €262 from a single wager. Such instances underscore the model’s ability to exploit market inefficiencies and errors to generate substantial returns.

Conclusion

In conclusion, while the model’s impressive ROI is noteworthy, it underscores the importance of adhering to a disciplined betting approach. Consistently following the model’s recommendations, even when they seem risky, is crucial for achieving long-term success. This result also highlights the significant role that bookmaker odds play in the model’s performance. Although snooker is a relatively low-variance game — played in a controlled environment with consistent conditions and less susceptibility to factors like injuries — the odds provided by bookmakers can occasionally diverge from predictions. By capitalizing on these discrepancies, bettors can place value bets and potentially achieve substantial gains. The key takeaway is that a disciplined, data-driven approach can exploit market inefficiencies, leading to profitable betting outcomes.

Monitoring the model over an appropriate timescale is crucial to account for variability and ensure accurate assessments. Short-term fluctuations can introduce significant variance, so a substantial number of bets is necessary to draw reliable conclusions. Conversely, bookmaker odds are continuously adjusted based on market dynamics and betting activity. As the market corrects inefficiencies, the model’s performance may be affected. Therefore, while tracking performance, it’s essential to consider both the model’s long-term trends and the potential for changes in market conditions that could influence future results.